Creditas financial results Q4 2020

São Paulo, 01 February 2021

Today, we announce the results corresponding to the 4th quarter of 2020.

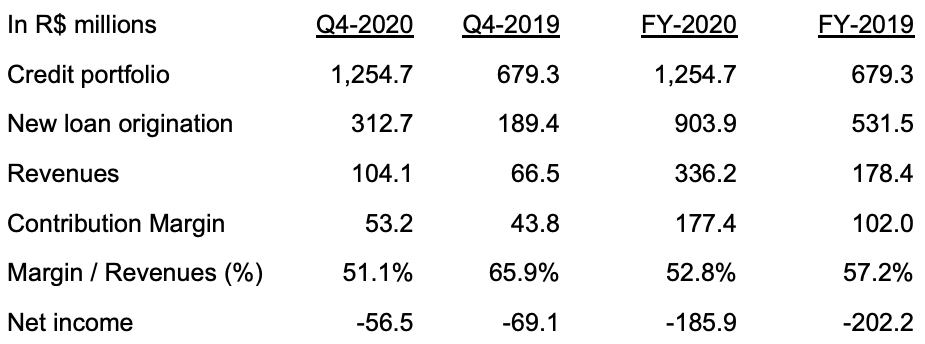

In Q4-20 our revenues passed the R$100mn mark due to the growth reacceleration started in Q3-20 and expansion of our credit portfolio. The continued high quality of our credit portfolio and resilience of debt capital markets enabled us to continue the accelerated growth path that we had prior to COVID and resulted in a record new loan origination of R$312.7mn in the quarter.

Contribution margin (discounting funding costs, servicing costs, credit provisions and taxes) ended the quarter at 51.1% as we increased the leverage of the credit portfolio. Net loss fell 18% from Q4-19 despite increase in SG&A as we gain scale through the expansion of our credit portfolio and the related boost in revenues.

In Q4-20 we completed 4 securitizations for a total of R$239mn with Debt Capital Markets showing high resilience for Creditas as investors increase appetite to our unique asset class. We issued a new FIDC (FIDC Auto III) in which S&P reaffirmed the AAA local rating for the senior quotas.

***

Definitions

Credit portfolio.- Outstanding net balance of all our lending products net of write-offs. Our credit portfolio is mostly securitized in ring-fenced vehicles and funded by both institutional and retail investors.

New loan origination.- Volume of new loans granted in the period. If new loans refinance outstanding loans at Creditas, new loan origination includes only the net increase in the customer loan.

Revenues.- Income received from our operating activities including (i) recurrent interest from the credit portfolio, (ii) recurrent servicing fees from the credit portfolio related to our collection activities, (iii) up-front fees charged to our customers at the time of origination, (iv) up-front revenues recognized at the time of the securitization of the loans, and (v) other revenues from both lending and non-lending products.

Contribution Margin.- Margin calculation deducts from our revenues (i) costs of servicing our loan portfolio including headcount, data consumption and third party costs, (ii) costs incurred in our non-lending businesses necessary to generate revenues, (iii) funding costs of our portfolio comprising interests paid to investors and costs related to the issuance of our securitization (eg. auditors, rating agencies, advisors), (iv) credit provisions related to our credit portolio and (v) sales taxes related to fees, interest and other revenues.

Net income.- Net income deducts from our Contribution Margin (i) headcount not included in the credit portfolio servicing cost, (ii) general overhead cost, (iii) customer acquisition cost and (iv) other income and expenses.

Subscribe for

updates

Receive all our news in your email